Making Sense of the Post-Election Landscape

As the final pieces become clearer from last week’s presidential and congressional election for the next 2 years, there are many questions about how this will impact markets and portfolios. Former President Trump has won the presidential election and the Republican party has secured control of the Senate and a small majority in the House of Representatives. This single party control last occurred in 2020 with Democrats holding both houses of Congress and the presidency and then also recently in 2016 with Republican control again. There are many implications of how this election has played out but within the context of markets and portfolios, it’s imperative to separate politics and portfolios. Politics and investing are amnesia to each other, and both drive strong emotional responses from people. They are also unfortunately, a dangerous cocktail together and can distract and cloud investor judgement from making prudent investment decisions.

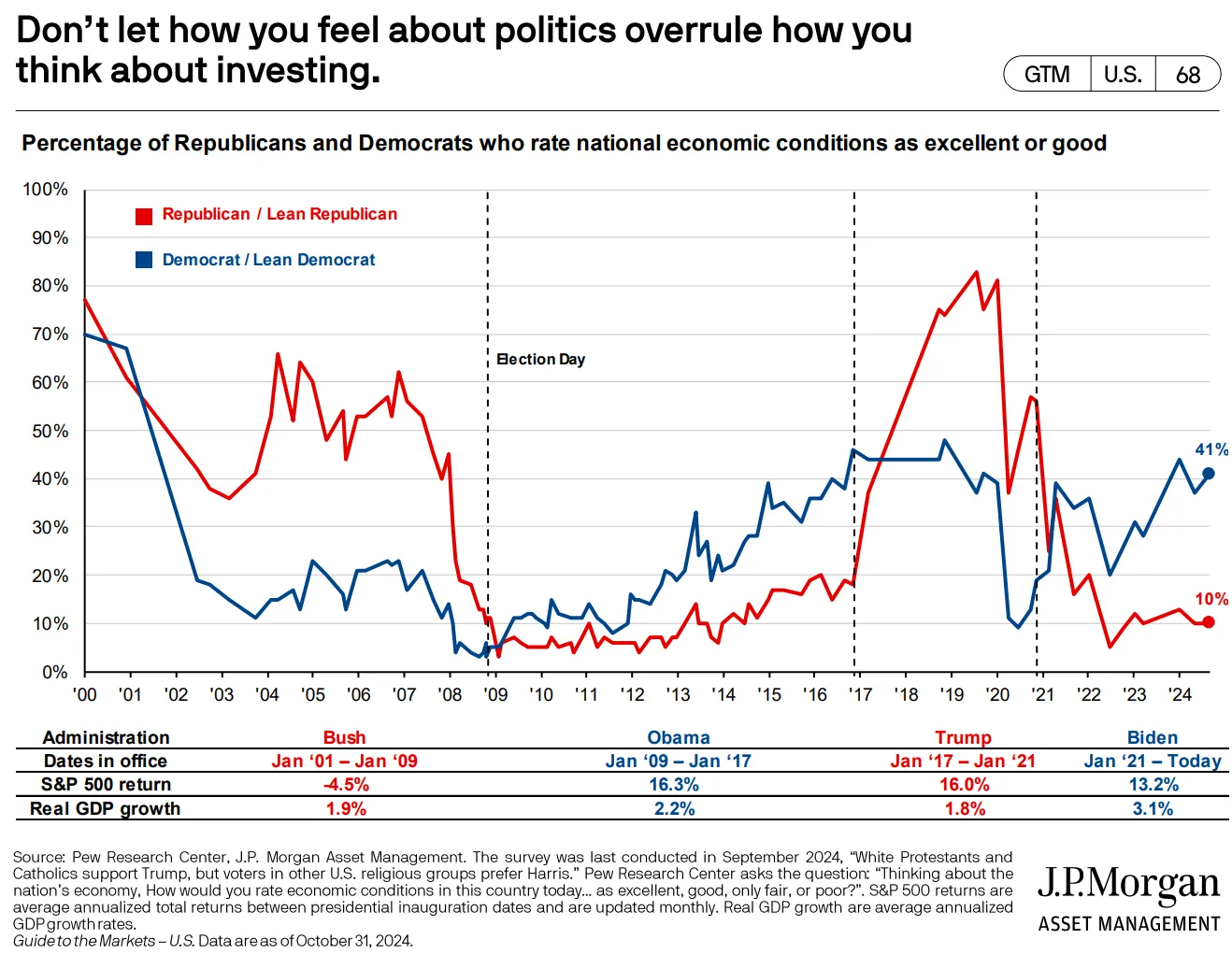

Historically, throughout many different presidential administrations and combinations of congress, the US economy and markets have continued performing strongly. This may not always seem true in the moment as the first chart below highlights an important observed emotional bias where an investor’s view of the markets is skewed based on their political party affiliation. This highlights the fact that many investor’s perception of the markets and economy can be influenced by their political tilt and cloud their judgement potentially interfering with their long-term financial goals. One example of this if an investor sat in cash due to fears about political outcomes, they would have left a lot of money on the table during different administrations. Under both the Obama and Trump presidencies, the S&P 500 returned an average of 16% and the economy grew at around 2% on average despite large swings in economic perceptions.

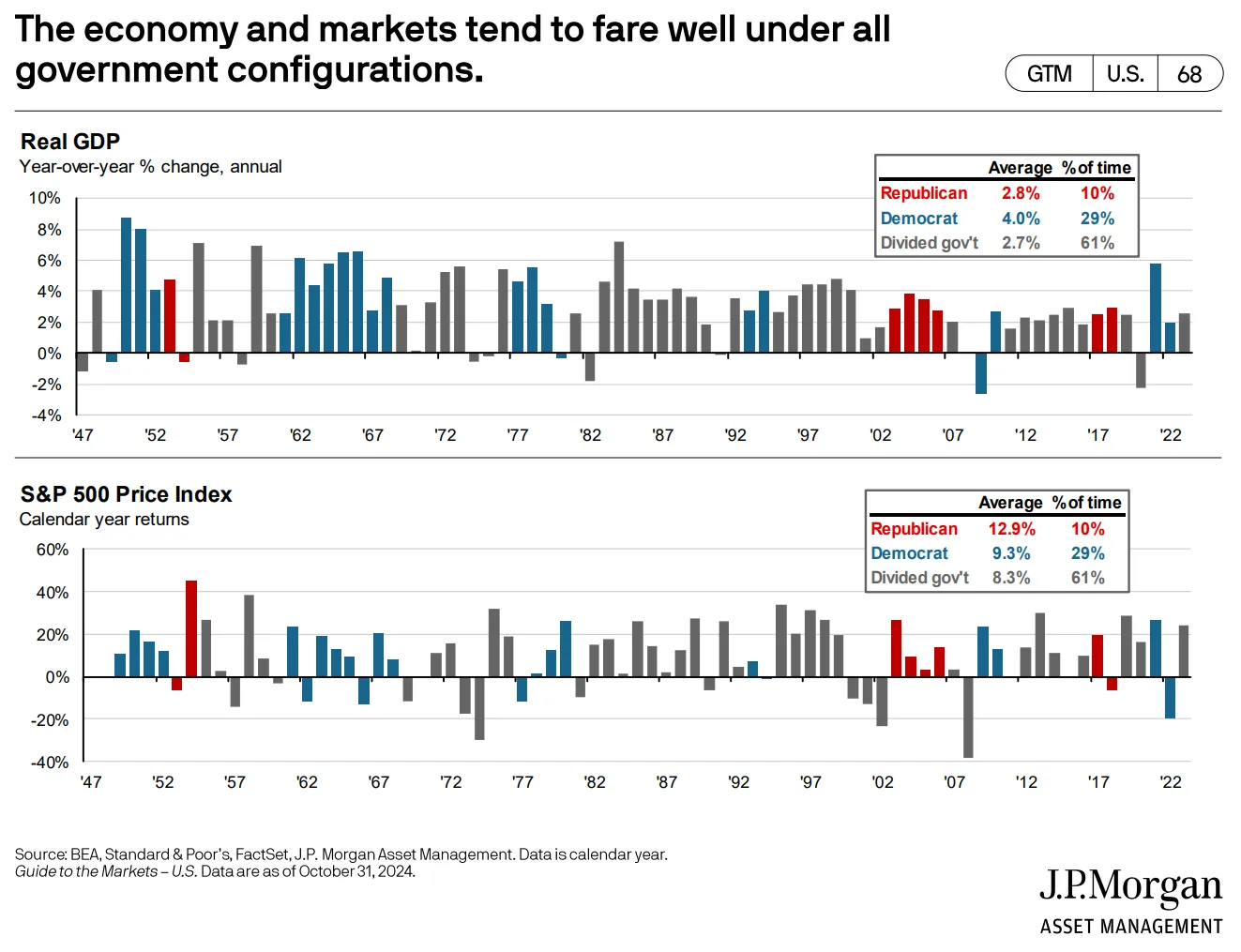

While many people may argue that the economy and markets perform definitively better under one party or the other, history points to both performing well over the long-run throughout a variety of different scenarios of government. Looking back, the most common configuration of the US government is divided which has produced ~2.7% annualized GDP since World War 2, and 8.3% annualized returns in the S&P 500. The country also recently saw the presidency and both houses of Congress controlled by the same political party in 2020 and 2016 for 2-years each time and the figures below highlight that these more uncommon scenarios have still resulted in positive growth and equity returns.

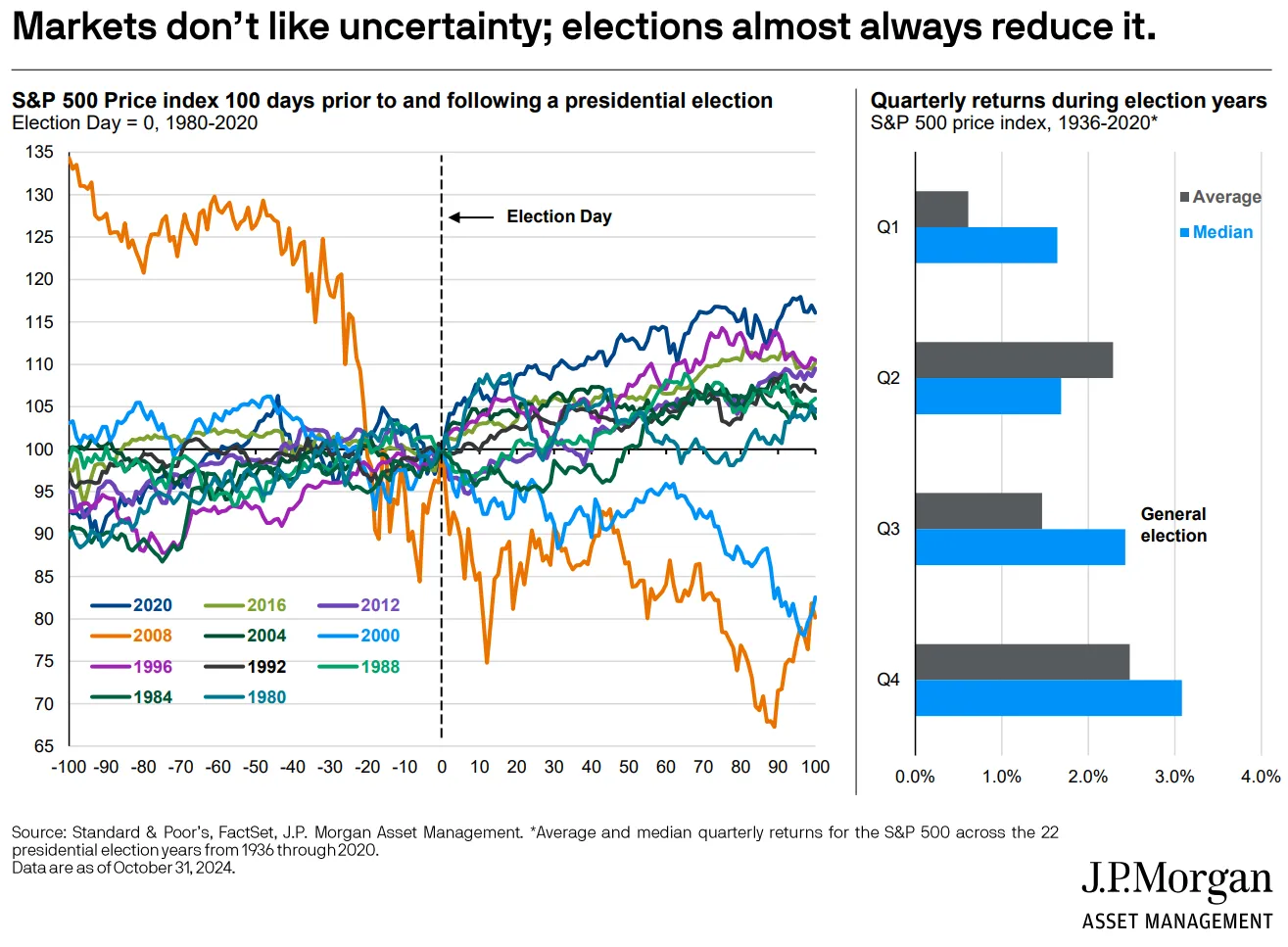

Volatility in the equity and bond markets have been high over the past 6 months which is consistent with historical patterns before a presidential election. History points to the market disliking uncertainty but then accepting resolution and moving forward strongly after elections. The 2x outliers shown in this chart are in 2008 and 2000 when the Great Financial Crises and the tech bubble burst and each continued weighing down economic performance to degrees far beyond what party was in power.

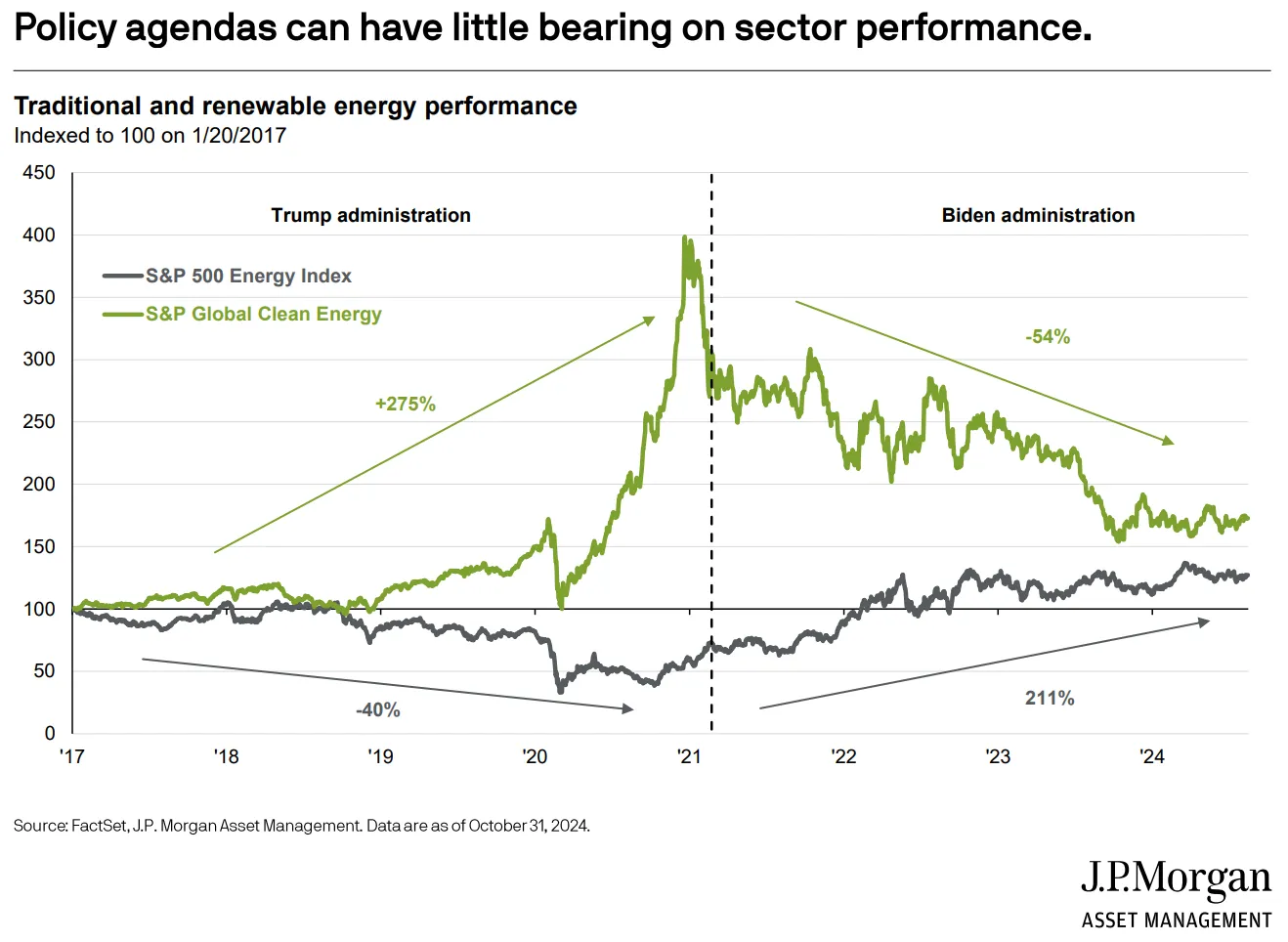

Another topic that can derail investors when combining investing and politics in the idea of reading too deeply into policy and trying to anticipate stock or sector performance. This frequently happens in the run-up to an election or immediately afterwards as investors try to opportunistically position for rallies or pullbacks in certain sectors. This is extremely difficult to successfully do as the combined idiosyncratic risks of policy, individual companies and their management as well as the marketplace at large intertwine to create situation where changes in any of these variables become extremely difficult to successfully navigate. A recent example of this is during the Biden administration when the President campaigned on scaling back fossil fuels and prioritizing renewables while passing the largest ever fiscal commitment to climate through the Inflation Reduction Act. Contrast this with President Trump’s first administration when he campaigned to vigorously support the traditional energy industry. The sector performance of green energy and traditional energy was the opposite of what one might expect during each administration. During President Trump’s term, traditional energy declined significantly which clean energy appreciated. However, under President Biden’s administration traditional energy stocks nearly doubled while clean energy stock prices declined almost -50%. In the end, varying supply and demand factors and interest rates had a greater impact on each of these industries than any policies put forward by the government.

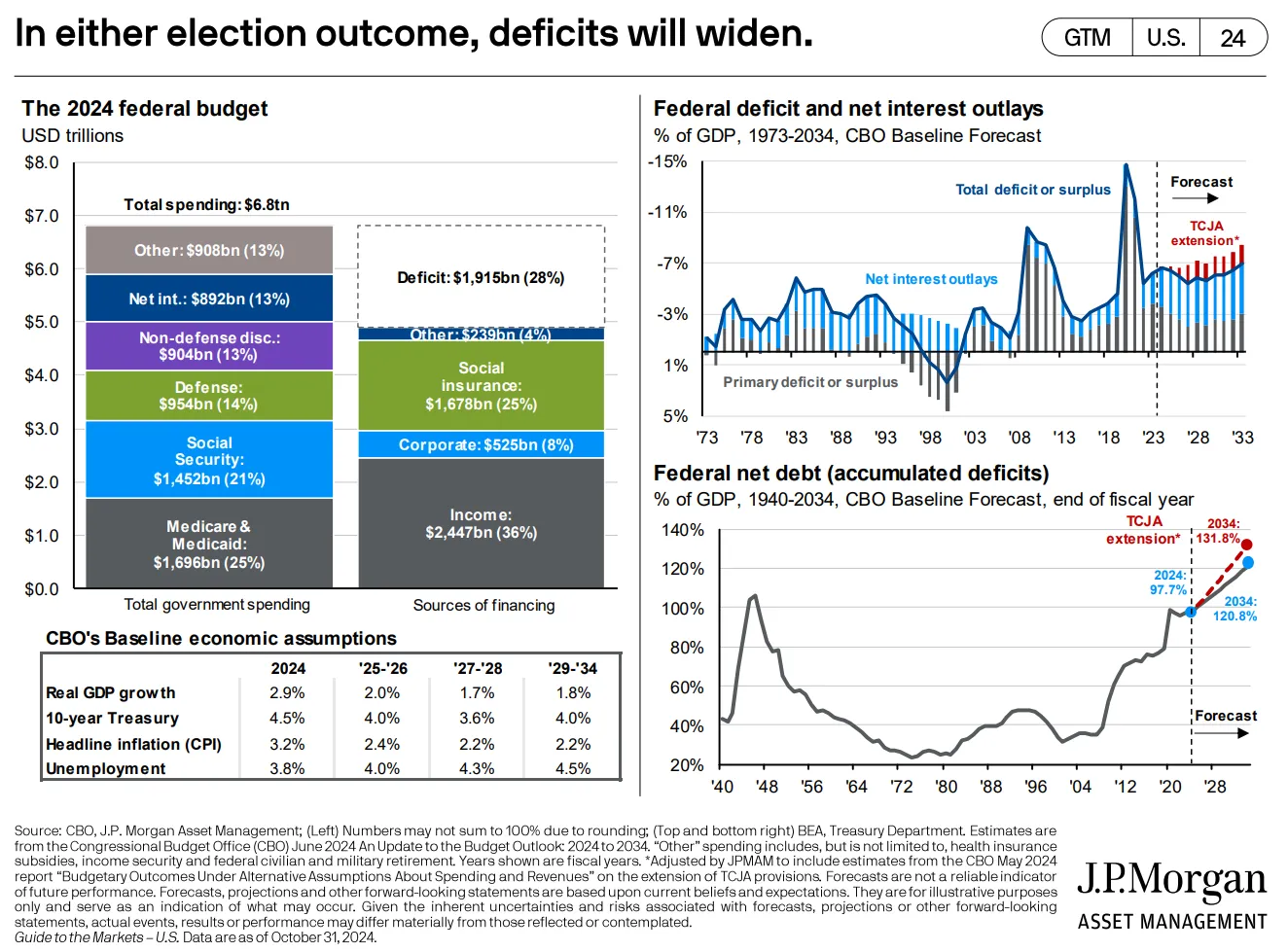

Two themes that will very much continue to be in focus moving are federal deficits and the budget along with global supply chain reorganization. Federal deficits will likely be more and more in the forefront of the news and investors minds as neither political candidate appeared to put much focus on the risks of the federal deficits continuing to grow beyond historical peacetime precedent and their potential impact on federal borrowing, interest rates and inflation. This complex topic is difficult to discuss in sound bites during the presidential campaign but will require some seriousness in the not too distant future.

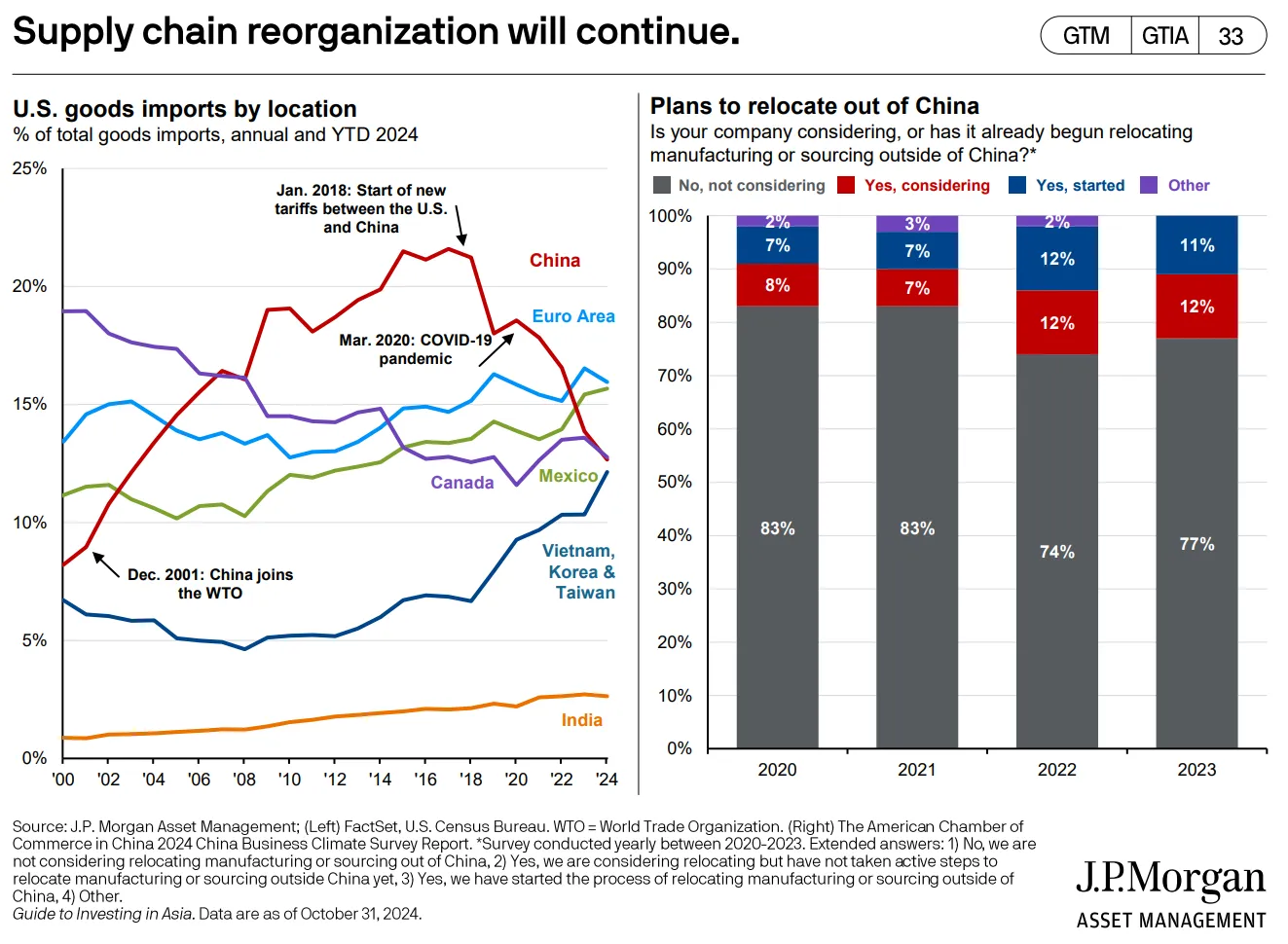

Global supply chain reorganization will likely continue to be a strong theme moving forward as well into this administration. The trend of “friend-shoring” and diversifying from Chinese production has been underway since the escalation of trade tensions with China in 2017 and 2018. Since then, the share of US imports from China has been declining while imports have increased from Europe, Mexico, Canada, India and other Eastern Asian countries to close the gap. Many companies have been moving their production closer, in a geographic sense, to their largest markets and trying to mitigate potential risks that may arise in a world with strong geopolitical divides.

Brio is focused on your financial future and this often means taking a step back, being objective and filtering out noise to chart a path forward. While politics is a very personal and important topic for many clients, we strive to maintain a diversified portfolio that weather all seasons. This can be emotionally trying when the news cycle is filled with sound bites and policy proposals that may challenging to fully understand in a quickly evolving world but we are positioned to help navigate you through these choppy seas.

Disclosure:

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security. It is only intended to provide education about the financial industry. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. Any past performance discussed during this program is no guarantee of future results. Any indices referenced for comparison are

unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional.

Brio Financial Group is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Brio Financial Group and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Brio Financial Group unless a client service agreement is in place.