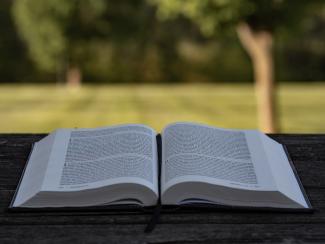

The Chapters of Retirement

by Brandon Miller on May 29, 2019

The journey to and through retirement occurs gradually, like successive chapters in a book. Each chapter has its own things to consider.

Chapter 1 (the fifties). At this stage of life, retirement becomes less like a far-off dream and more like a forthcoming reality. You begin to think about when you can retire and about taking the right steps to retire comfortably.

During your fifties, you may contend with “lifestyle creep” – the phenomenon of your household expenses growing along with your pay raises. These increased expenses may include housing costs, education costs, health care costs, and even eldercare costs. Despite these financial strains, the inflow of new money into retirement accounts must not cease; your retirement plan assets should not be drawn down through loans or withdrawn too early.1

Chapter 2 (the early sixties). The anticipation builds at this point; you start to think about the process of retiring and the precise financial and lifestyle steps involved. You also begin to think about the near future – not only what you will do next, but how you will do it.

You may have to act on your plans to volunteer or start an encore career earlier than you think. If you do not have a set plan for the next chapter, a phased retirement may give you more of an opportunity to determine one.

This is also a time to dial down risk in your portfolio, especially if a bear market occurs right before you retire. You have little time to recover from a downturn.

Chapter 3 (the start of retired life). The first year or so of retirement is akin to a “honeymoon phase” – you have the time and perhaps the money to pursue all kinds of dreams. The key is not to spend wildly. Lifestyle creep also affects new retirees; free time often means more chances to spend money.

Chapter 4 (the mid-sixties through the late seventies). This is when some people get a little restless. It is also when some people find their retirement savings growing disturbingly smaller. You may get bored with an all-leisure, all-the-time lifestyle and decide to volunteer or work on your own terms, health permitting. You may want to adjust your retirement income strategy or see if new streams of income can be arranged.

Chapter 5 (eighty & afterward). The last chapter of retirement is one frequently characterized by the sharing of legacies and life lessons, a new perspective on the process of living and aging, and deeper engagement (or reengagement) with children and grandchildren. This is also the time when you should think about your financial legacy and review or update your estate plan, so that when you leave this world, things are in good order, and your wishes are followed.

Before and during your retirement, it is wise to keep in touch with a financial professional who can guide and consult you when questions about income, investments, wealth protection, and wealth transfer arise.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security. It is only intended to provide education about the financial industry. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. Any past performance discussed during this program is no guarantee of future results. Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional.

Brio Financial Group is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Brio Financial Group and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Brio Financial Group unless a client service agreement is in place.

1 - forbes.com/sites/camilomaldonado/2018/08/23/slippery-slope-lifestyle-creep [8/23/18]